nordic food tech venture capital

The fund managed by nordic food tech venture capital oy raised eur 2455 million from institutional. Launched last year the.

Nordic Foodtech Vc Crunchbase Investor Profile Investments

Much More than a Venture Capital Firm.

. Idea or Patent 2. Matthew has over 18 years of experience in investment banking. Ad See what you can research.

Nordic Foodtech VC announced the closing of its first fund at 42M exceeding the 40M target size. Interviews with individuals and orgs creating the future through food. The fund managed by nordic food tech venture capital oy raised eur 2455 million from institutional and private investors such as business finland venture capital oy.

Nordic FoodTech the venture capital firm investing in alternative protein and sustainable food startups has closed its first fund with 42 million. We invest in early-stage Nordic and Baltic tech companies solving hard problems in global food system. Tomorrow at 130 PM 119 more events.

215 rundown of gunnars career and opening. Janina Sibelius 2020-05-01 With. Ad Your comprehensive source for data across the global venture capital ecosystem in 2022.

Nordic Food Tech is a leading source of ideas within food and beverages creating a long range of solutions. Find company research competitor information contact details financial data for Nordic Food Tech Venture Capital Oy of HELSINKI Uusimaa. The fund will start investing with a capital of eur 2455 million.

1365 Main St The Marketplace Springfield MA. Web Research Social Selling. Founded Date Apr 8 2020.

MassVentures runs the Massachusetts Technology Transfer Center and offers SBIR support business mentoring curated matches with. I pulled together three of the top investors in food and ag from the Nordics for a fast-paced spirit conversation on how they view and are investing in the future of. Nordic Food Tech Venture Capital Oy 2924521-2 Nordic Food Tech Venture Capital Oy 2924521-2 on perustettu vuonna 2018 ja sen toimialana on Muut palvelut liike.

ANNEAai GmbHs Seed Financing Round. Transformation of the global food system is an urgent necessity for human health for life on. Ad Compare Top 7 Working Capital Lenders of 2022.

Nordic Food Tech Venture Capital. 11 rows nordic foodtech vc is the first venture capital fund in the nordics investing explicitly. Everything you need to know about 2022 VC trends industry stats top investors and more.

Louise Samet is a Swedish investor who has a proven track record of facilitating high-growth companies to rise to success. Insights you cant get anywhere else. Everything you need to know about 2022 VC trends industry stats top investors and more.

Mika Kukkurainen CEO of the first Nordic food technology venture capital fund speaks to FBNW about the funds mission and challenges. Apply Now Get Low Rates. Deal terms deal multiples pre- and post-money valuations.

Come get your loan. Nordic food tech venture capital Thursday June 9 2022 Edit. Headquarters Regions European Union EU Nordic Countries Scandinavia.

Funding in as little as 24 hours. Ad At least 12 months in business monthly revenue of 20k. The Nordic FoodTech Podcast maps the ecosystem while sharing diverse points of view.

Ad Your comprehensive source for data across the global venture capital ecosystem in 2022. B2B intelligence at your fingertips. Advance Your Career Now.

Nordic FoodTech VC is a venture capital firm that invests in the future of food. Nordic FoodTech VC is the first fund in the Nordics investing explicitly in the future of food. Apply now to see options from 75 lenders.

Hiring Full Part Time. Ad Search Jobs in Your Area. The fund invests in early stage Nordic and Baltic tech.

The fund was launched in April 2020 as the first early-stage VC fund in the. Nordic FoodTech VC is the first venture capital fund in the Nordics investing explicitly in the future of food. Request a free trial.

Nordic FoodTech VC 1101 followers on LinkedIn. Get the latest business insights from Dun. Samet previously worked for five years as the Group.

Our first brand NØD Snacks is solving some of the worlds challenges one bite at a. Nordic Food Tech Venture Capital. The firm invests in founders leveraging the best possible technologies to renew the food chain.

Contact Company Search. Investing in bold Nordic innovation to transform the global food system Investing in bold Nordic innovation to transform global food. Founders Jari Tuovinen Lauri Reuter Mika.

Nordic Eye Venture Capital 32 Deals 26 Portfolio Startups Statistics Unicorn Nest

Nordic Foodtech Vc Investor Profile Portfolio Exits Pitchbook

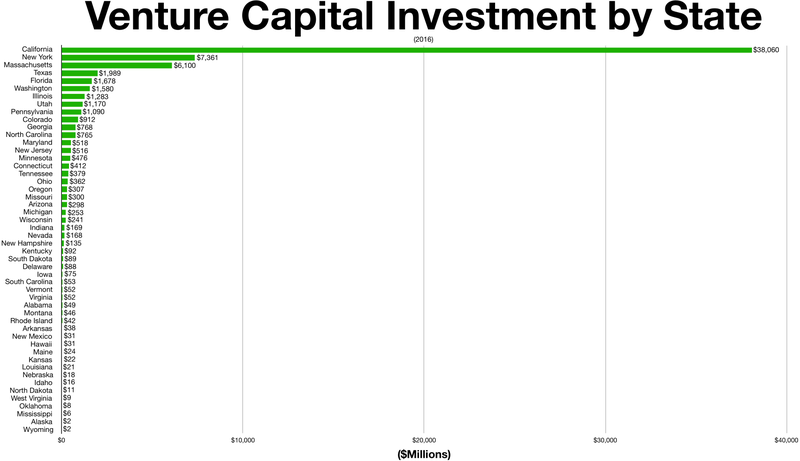

White Star Capital Canadian Venture Capital Landscape 2018

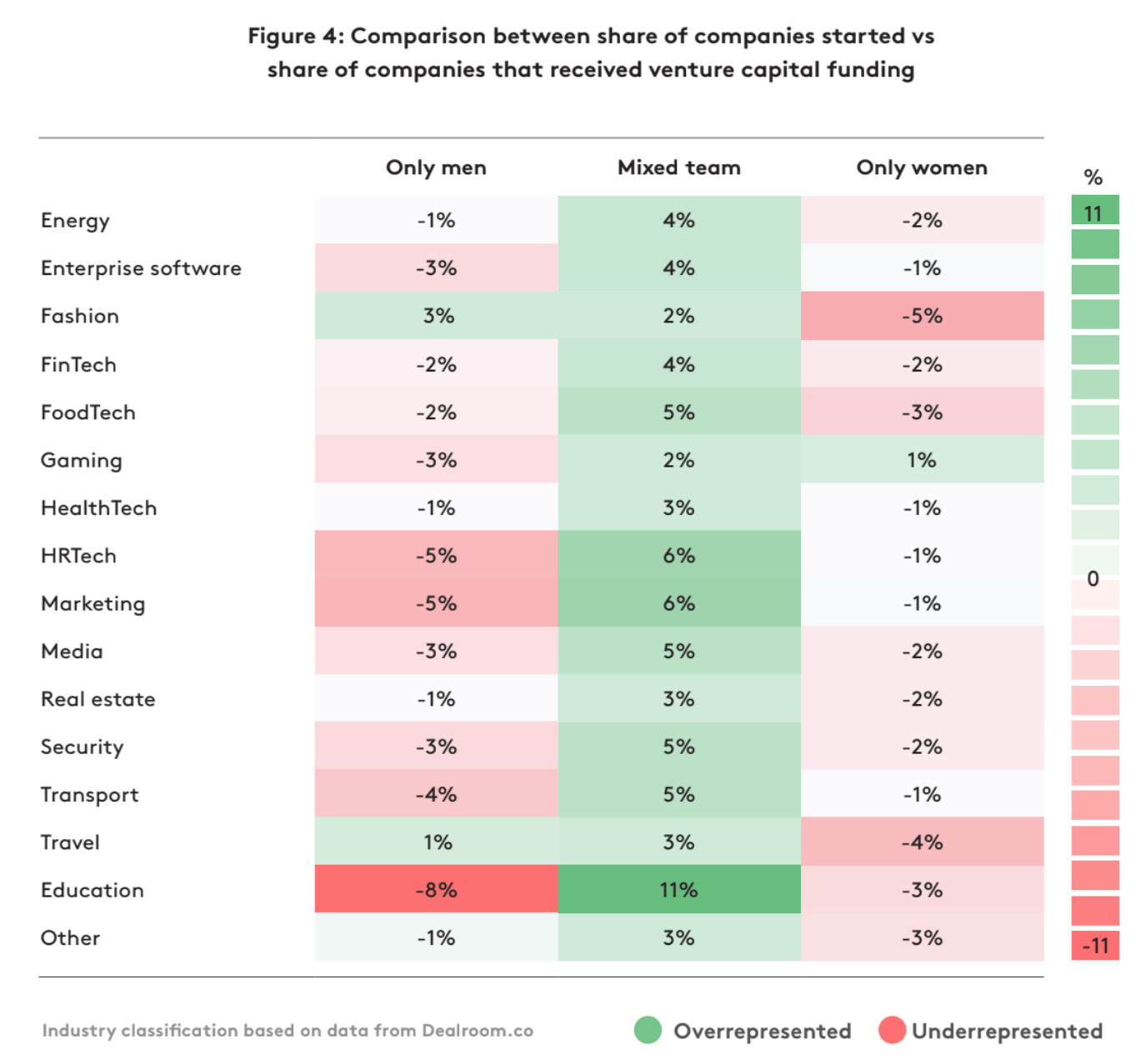

New Research Confirms If You Re A Female Startup Founder Fat Chance Raising Venture Funding In Europe Tech Eu

Link Venture Capital Home Facebook

List Of Top Finland Venture Capital Investors Crunchbase Hub Profile

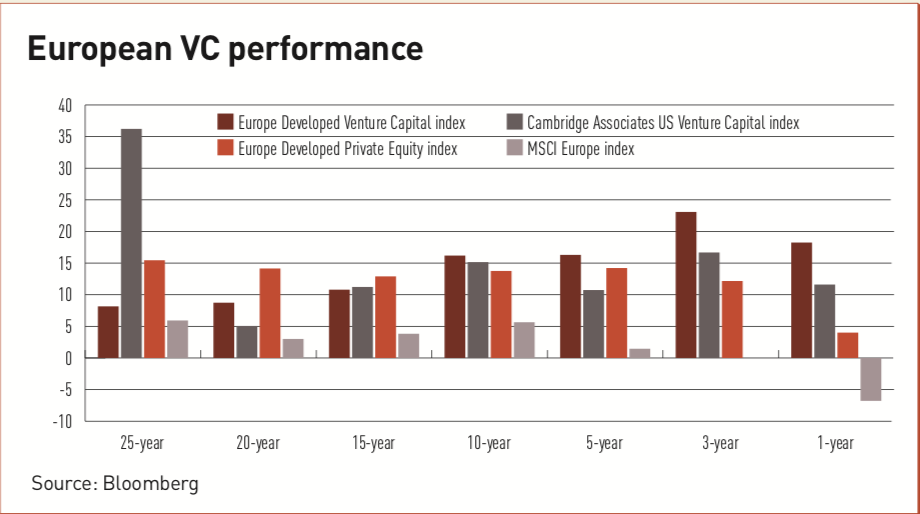

Venture Capital Shining Lights Special Report Ipe

Vietnam Startup Funding Ecosystem 2019

Venture Capital Nyongesa Sande

Demystifying Venture Capital By Mohammad Mustafa Ebook Scribd

Venture Capital Company Logo Logo Design Contest 99designs

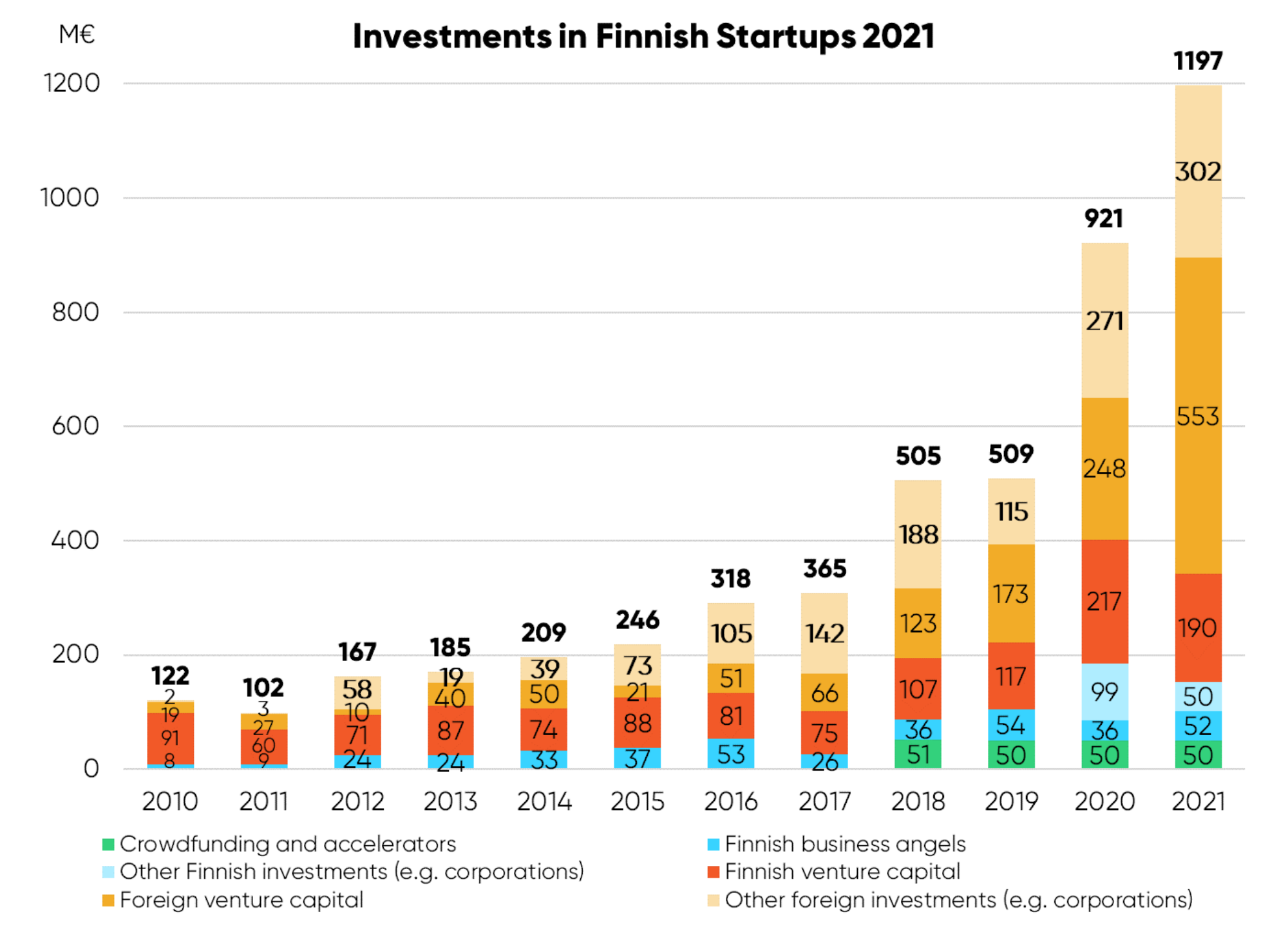

Finnish Venture Capital Association Reports The Highest Yearly Amount So Far Arcticstartup

National Innovation Foundation India Examples Of Frugal Innovation From India Innovation Design Thinking Foundation

Nordic Food Tech Venture Capital Home Facebook

Diving Into The Nordic And Baltic 2020 Venture Capital Landscape

Nordic Food Tech Venture Capital Home Facebook

European Capital Map 2022 Venture Capital And Private Equity Report